Asian shares fell on Friday and the dollar held steady after US consumer prices rose more than anticipated, supporting the Federal Reserve’s decision to maintain higher interest rates for longer.

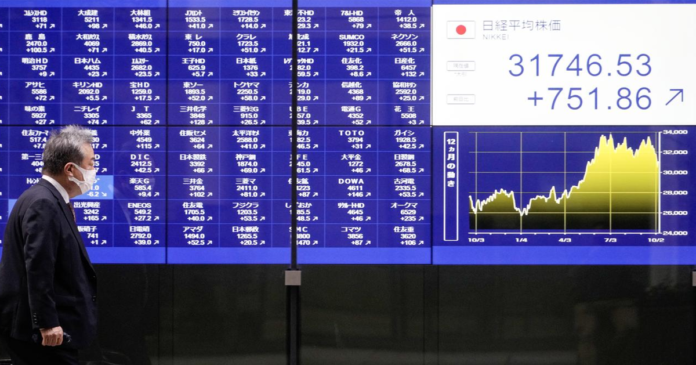

Asian shares drop: After reaching a three-week high on Thursday, MSCI’s broadest index of Asia-Pacific shares outside of Japan declined 0.94% on Friday, on track for its largest one-day percentage drop in a week.

Chinese stocks experienced unusually steep declines as data earlier in the day showed that consumer prices in China remained unchanged in September, but factory-gate prices declined more slowly, indicating persistent deflationary pressures.

Early morning trading saw the Hang Seng Index fall 1.5% while the CSI300, a measure of blue-chip stocks in China, dropped 0.80%. In contrast, the Nikkei in Japan fell by 0.13%, and the S&P/ASX 200 index in Australia fell by 0.25%.

Rental prices unexpectedly increased in September, contributing to the rise in US consumer prices. As a result, traders now believe the Fed will raise interest rates again this year.

A rate increase in December is roughly 40% more likely, according to futures contracts that settle at the Fed’s policy rate, than it was before the inflation report.

The CPI statistics, according to Ryan Brandham, head of global capital markets for Validus Risk Management in North America, underscores the difficulties the Fed will encounter in lowering inflation to its 2% target.

Separate data also revealed that during the week ended September 30, the number of Americans receiving benefits following a first week of aid—a proxy for hiring—rose 30,000 to a still-low 1.702 million.

“Economic Trends and Market Reactions: The Path to Achieving Inflation Targets and Interest Rate Hikes”

“The labour market softening is key to the Fed achieving its goal of returning inflation to target, and the hawks calling for at least another hike will be supported based on these numbers,” Brandham stated. Treasury rates increased on Thursday as a result of the inflation report and weak demand for an auction of US 30-year notes.

The yield on 10-year Treasury notes decreased by 3.7 basis points to 4.674% during Asian hours on Friday, although it was still significantly higher than the two-week low of 4.5300% it had reached the day before.

After Federal Reserve officials made remarks hinting that US interest rates, which often influence global borrowing costs, may have reached their peak, observers noticed recent increases in stocks and a decline in Treasury yields.

The most recent US CPI report “undid much of the ‘good’ work done in the past week in the form of bull flattening of the US yield curve,” according to Ray Attrill, head of FX strategy at National Australia Bank.

The rapid rise in Middle East tensions over the past week has also assured that markets are still in a cautious mindset. “On October 19, Federal Reserve Chair Jerome Powell’s statements, just before the US central bank’s blackout period preceding its next interest-rate decision, will become the next topic of attention for investors.”

The Federal Reserve will meet again from October 31 to November 1.

The currency market reflected the risk-off attitude, with the dollar holding onto overnight gains. The dollar was up 0.8% overnight and was trading at 106.47 against a basket of currencies.

Sterling was at $1.2193, up 0.16% on the day, while the euro was up 0.13% to $1.054.

The Japanese yen is currently trading at 149.82 to the dollar as a result of the strengthening dollar.

Despite a little increase on Friday, gold prices were still below two-week highs reached the previous day. An ounce of spot gold increased by 0.2% to $1,872.17.

After the US reinforced its sanctions plan against Russian crude shipments, the price of oil increased on Friday, heightening supply concerns in a competitive market.

US crude increased by 0.63% to $83.43 a barrel, while Brent was up by 0.38% for the day at $86.33.