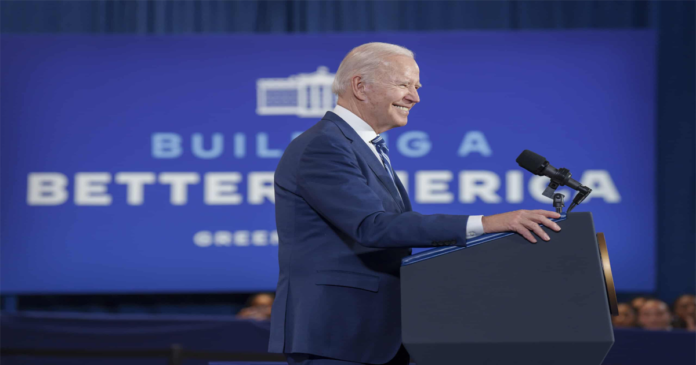

President Joe Biden of the US signed an executive order on Wednesday to limit certain American investments in critical high-tech sectors in China; this was denounced as “anti-globalization” by Beijing.

Biden orders ban US tech investments in China: As part of Washington’s effort to restrict access to important technology, the long-awaited regulations, which are slated to be adopted next year, target industries including semiconductors and artificial intelligence.

In a letter to Congressional leaders announcing the executive order, Biden stated that “the commitment of the United States to open investment is a cornerstone of our economic policy and provides the United States with substantial benefits.”

Although some US expenditures “may accelerate and increase the success of the development of sensitive technologies and products in countries that develop them to counter US and allied capabilities.”

According to the Treasury Department, the initiative will forbid new private equity, venture capital, and joint venture investments in sophisticated semiconductors and some quantum information technologies in China.

Under the condition of anonymity, a senior government source stated, “The outbound investment programme will fill a critical gap in the United States’ national security toolkit.”

What we’re discussing is a focused strategy designed to keep [China] from acquiring and utilising cutting-edge technology to accelerate military modernization and jeopardise US national security.

“US Treasury Contemplates Investment Rules for Chinese Companies Amidst Sensitive Technology Concerns”

The Treasury is debating whether there should be a notice requirement for US investments in Chinese companies engaged in less sophisticated semiconductors and certain types of artificial intelligence.

The Treasury Department warned that China could take advantage of US investments to increase its capacity to develop sensitive technologies vital to military modernization.

However, it plans to provide an exception for some transfers from US parents to US subsidiaries and investments in publicly traded US securities.

The move was denounced by China’s foreign ministry as an effort to “engage in anti-globalization and de-sinicization,” and the ministry issued a dire warning that China would “resolutely safeguard its own rights and interests.”

Beijing “has lodged solemn representations with the United States” and “is strongly dissatisfied and opposes the United States’ insistence on introducing restrictions on investment in China,” the ministry said in a statement.

frightening impact?

According to Emily Benson, director of the Project on Trade and Technology at the Centre for Strategic and International Studies (CSIS), while the dollar amount or number of transactions covered by a ban or notification regime is likely to be quite small, it does not imply that the overall impact will be limited.

“It’s possible that companies will rethink the nature of their investments even though they’re not directly subject to bans, and that could have a chilling effect on bilateral investment over time,” Benson told AFP.

The most recent restrictions were put in place soon after several high-ranking US officials visited China as Washington and Beijing work to normalise relations.

Both American and Chinese officials discussed possible limitations during US Treasury Secretary Janet Yellen’s visit to China’s capital last month. She assured reporters that any future actions would be taken in a transparent manner.

In that statement, Yellen highlighted that the action would be “highly targeted” and “clearly directed narrowly at a few sectors where we have specific national security concerns.”

She continued by expressing her desire to assuage concerns that Washington would take actions that would have wide-ranging effects on the Chinese economy.

“Enhancing Foreign Investment Frameworks: Insights and Alignment Efforts by Experts and Officials”

According to Nicholas Lardy, a senior scholar and non-resident at the Peterson Institute for International Economics (PIIE), “about one to two percent of investment in China has been financed by foreign capital in recent years.”

Get other nations that are making these kinds of investments in China to have a similar framework, he urged, if you want to make a difference.

Additionally, A senior government official claimed on Wednesday that important allies and partners have acknowledged the significance of this problem and that “some are seeking to align” their policy stances.

Further, Benson emphasised that restrictions on outbound investment would not amount to an all-out effort to stop Washington and Beijing from collaborating more closely.

However, The US must, she said, “really demonstrate through targeted language that this is not going to cause huge disruption in investment” as the administration has been attempting to arrange high-level meetings with Chinese officials.